Does my employee need a written statement of employment?

The main purpose of the written statement of employment, often referred to as the contract of employment, is to clarify the terms of a person’s employment and avoid uncertainty or misunderstandings, where employee expectations might not be the same as employer intentions.

The Terms of Employment (Information) Acts 1994 require an employer to provide an employee with a written statement of their terms of employment within 2 months of commencement of employment. The above Act covers all employees working under a contract of employment, including full-time staff, part-time staff, fixed-term and casual workers.

The written statement must include the following information:

- The full name of employer and employee

- The address of the employer

- Place of work

- Job title or nature of work

- The date the employment started

- Type of contract

- Rate of pay

- Pay intervals

- Hours of work

- Paid leave

- Incapacity for work, sick pay

- Any terms relating to a pension scheme

- Period of notice to be given by employer or employee

- Details of any collective agreements

- Pay reference period

Additional clauses can be recommended to further clarify the relationship. These might include:

- Probation clause

- Pay in lieu of notice clause

- Confidentiality clause

- Right to search

- The calculation of holiday pay

Failure to comply with the above Act could leave employers open to a claim from their employees. Employers found not to have written terms of employment in place will be fined a maximum of 4 weeks’ remuneration per employee. Clearly worded contracts of employment are key to the success of any business. They will ensure your business is on the right side of employment law as well as help prevent disputes with employees.

To book a free online demo of Bright Contracts click here

To download your free trial of Bright Contracts click here

Budget 2018 - Employer Payroll Focus

Pay As You Earn (PAYE)

- There was no change to tax rates for 2018, the standard rate will remain at 20% and the higher rate at 40%.

- Standard Rate Cut Off Points (SRCOPs) will be increased by €750 from 1st January 2018.

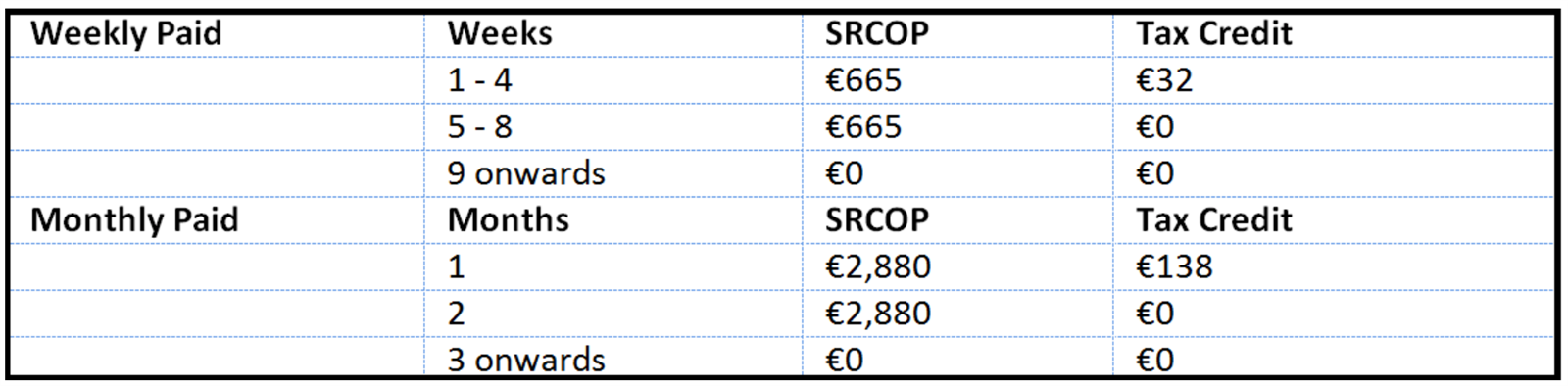

Emergency Basis of PAYE

Employee provides PPS Number:

Where an employee does not provide their PPS Number the higher rate of 40% tax applies to all earnings.

Earned Income Tax Credit

The Earned Income Tax Credit will be increased by €200 from €950 to €1,150.

Home Carer Tax Credit

The Home Carer Tax Credit will be increased from €1,100 to €1,200.

Universal Social Charge (USC)

- Exemption threshold remains at €13,000

- 2.5% rate reduced to 2%, threshold for this rate increased from €18,772 to €19,372

- 5% rate reduced by 0.25% to 4.75%

- No change to 8% rate

Medical card holders and individuals aged 70 years and older whose aggregate income does not exceed €60,000 will pay a maximum rate of 2%.

The emergency rate of USC remains at 8%.

PRSI & USC

The Minister outlined his intention to establish a working group in 2018 to carry out a review of the possible integration of PRSI and USC.

National Training Levy

The National Training Levy of 0.7% which is currently collected as part of the employer PRSI contribution will increase to fund further and higher education, the increases are as follows:

- 0.8% in 2018

- 0.9% in 2019

- 1% in 2020

Pay Related Social Insurance (PRSI)

There were no changes to general PRSI thresholds or employee PRSI announced in the Budget. However, as the National Training Levy is increasing and it is collected as part of the employer PRSI contribution, employer PRSI will increase as follows:

- 8.5% increased to 8.6%

- 10.75% increased to 10.85%

Benefit in Kind (BIK) - Electric Cars

A 0% rate of BIK will apply to electric vehicles provided by an employer to an employee in 2018 which is available for private use. Electricity used by the employee in the workplace to charge the car will also be exempt from BIK.

PAYE Modernisation

PAYE Modernisation will be effective from 1st January 2019. Budget 2018 has allocated €50 million for a project to enhance Revenue's IT capacity and to ensure employer compliance.

National Minimum Wage

The National Minimum Wage will increase from €9.25 to €9.55 per hour in respect of hours worked on or after 1st January 2018.

- Workers under age 18 will be entitled to €6.69 per working hour

- Workers in their first year of employment over the age of 18 will be entitled to €7.64 per working hour

- Workers in their second year of employment over the age of 18 will be entitled to €8.60 per working hour

Social Welfare Payments

There will be a €5 increase in all weekly Social Welfare payments with effect from 26th March 2018. The maximum personal rate of Illness Benefit will be increased to €198 per week. Maternity Benefit and Paternity Benefit will be increased to €240 per week.

Be careful of age discrimination in job adverts

Age discrimination in job advertisements has become an increased issue recently and employers need to ensure they are acting lawfully under the Employment Equality Act, 1998. Such discrimination can be seen in advertisements that exclude people applying for certain roles based on their age. Specifically advertising for younger or older people not only limits your chances of finding the right candidate but also discriminates against people of certain ages and a claim can be made against you to an employment tribunal.

Ambitious Young People

Using phrases like “ambitious young people” or “youthful and energetic” straightaway excludes people from a certain age bracket to apply for these roles. These phrases clearly deter older, suitable persons from applying for such roles. With thousands of job advertisements asking for “recent graduates” it discriminates against someone who may have graduated over 10 years ago, but would also be highly suited for the position.

5+ Years’ Experience

Many young people are finding job advertisements that show clear signs of age discrimination impossible barriers to apply for these roles and getting a foot on the career ladder. If a job advertisement asks the candidate to have 5 years + experience in a particular role it could be seen as discriminating against someone who hasn’t yet had the opportunity to gain that experience as they are too young.

Learning Points

When writing a job advertisement it must be carefully written so that the criteria for the role doesn’t make it impossible for, or discourage a certain age group to apply. There are special circumstances where you may look for a particular age group to apply, and in these instances, you must have a justifiable reason or certain necessary requirements of the role and these must be clearly included in the advertisement.

For further information on how to avoid discrimination in your recruitment process please see here.

To book a free online demo of Bright Contracts click here

To download your free Bright Contracts trial click here