Christmas Public Holiday Entitlements

There are three public holidays coming up over the festive season – Christmas Day, St. Stephens Day and New Year’s Day. Although many offices across the country will close during this period it can be one of the busiest times of the year for industries including retail, hospitality, and hair and beauty. So what public holiday entitlement are employees entitled to over this time?

Full-time employees

Full-time employees have immediate public holiday entitlement to one of the following:

• A paid day off that day

• A paid day off within a month of that day

• An additional day of annual leave

• An additional days pay

Part-time employees

If a public holiday falls on a day that a part-time employee usually works, they are entitled to one of the public holiday benefits as listed above, if they have worked at least 40 hours in total in the 5 weeks prior to the public holiday.

Where the public holiday falls on a day on which the employee does not normally work, the employee is entitled to one fifth of his/her normal weekly wage.

Sick leave, absence and public holiday entitlement

If a full time employee is on sick leave during a public holiday, they are entitled to one of the public holiday benefits as listed above. If a part time employee is on sick leave during a public holiday, they are also entitled to one of the public holiday benefits listed above, if they have worked at least 40 hours in total in the 5 weeks prior to the public holiday.

Employees absent due to maternity leave, adoptive leave, parental leave, annual leave and jury duty accrue public holiday entitlement as if they were at work. Employees on carer’s leave continue to accrue public holiday entitlement for the first 13 weeks absence on carer’s leave.

The following type of absences occurring immediately before the public holiday will not be entitled to public holiday benefit.

• Absence in excess of 52 weeks due to occupational injury

• Absence in excess of 26 weeks due to illness or injury

• Absence in excess of 13 weeks for another reason and authorised by the employer including lay off

• Absence by reason of strike

Termination of employment

Employees who leave employment during the week ending before a public holiday and have worked the 4 weeks prior to that week are entitled to receive the benefits outlined above for that public holiday.

To book a free online demo of Bright Contracts click here

To download your free trial of Bright Contracts click here

Zero Hour Contracts - New Legislation

A new Bill, the Employment (Miscellaneous Provisions) Bill 2017, was published last week. According to the Employment and Social Protection Minister, Regina Doherty, the new Bill will prohibit zero hour contracts in most circumstances, as well as aiming to tackle problems caused by the increased casualisation of work and to strengthen the regulation of precarious work.

Key elements of the new Bill include:

Employers must give employees basic terms of employment within 5 days.

Within five days of a new employee starting employment, the employer must provide them with five core terms of employment. These 5 terms are:

- The full name of the employer and employee

- The address of the employer

- The expected duration of the contract (where it is a temporary or fixed-term contract)

- The rate or method of calculating pay

- What the employer reasonably expects the normal length of the employee’s working day and week will be.

Employers who fail to provide these basic terms, who deliberately mislead or give false information will be open to prosecution. This is a new offence.

In line with current legislation, the remaining terms of employment will still need to be provided within two months of the employee’s start date.

Zero hour contracts to be Prohibited in most circumstances.

Zero hour contracts will be prohibited in all circumstances except in cases of genuine casual work or where they are essential to allow employers to provide cover in an emergency situation or to cover short-term absences.

New minimum payment to be introduced.

Employees called into work but sent home again without work will now be entitled to a payment. Additionally, if an employee has not worked at all in a week or has worked less than 25% of their contract hours, they will also be entitled to a minimum payment. The payment shall be calculated as the pay that the employee would have receive had they worked the lesser of:

- 15 hours

- 25% of their normal contractual hours

- 25% of the work done for the employer that week

That minimum payment must be three times the National Minimum Wage or the rate set out in any applicable Employment Regulation Order.

Banded Hours

The Bill introduces new rights for new employees whose contract of employment does not reflect the reality of the hours they habitually work. For example, the contract states 15 hours per week where in reality the employee usually works 30 hours per week. After a work period of 18 months, an employee will be able to submit a written request to change their contractual hours. The employees request must be granted within two months, only in exceptional cases will the employer be permitted to refuse the request.

Penalisation of Employees

Employees seeking to invoke their employment rights under the Bill will have strong protections against penalisation. Where an employee successfully makes a complaint to the Workplace Relations Commission, they could be entitled to up to four weeks’ remuneration.

What’s next

The Bill was presented to the Dail on Thursday 7th December 2017, it is hoped that the Bill will be taken at Second Stage early in the New Year.

To book a free online demo of Bright Contracts click here

To download your free trial of Bright Contracts click here

Why not get more for you and your employees when making Bonus payments?

As the long dark evenings set in and Halloween is over, the build up to the most wonderful time of the year will begin again! At this time of the year a significant amount of employers pay-out a Christmas/annual bonus and no matter how little or large the bonus is, a large portion ends up being paid over to the Revenue if it is put through the payroll as a taxable addition.

For example, if an employee’s salary is €35,000 per annum and they receive a bonus of €1,000 at Christmas, this employee would only receive around half of this amount after tax, employee PRSI and USC. The company would also be liable to pay 10.75% employer PRSI on the bonus, so in addition to giving the bonus of €1,000 there is also the extra €107.50 meaning the bonus is in fact costing the company €1,107.50.

The Solution

Revenue allow one small non-cash benefit per employee per annum up to the value of €500, PAYE, PRSI OR USC do not need to be applied to the benefit. A gift card or voucher seems to be the most popular way of allowing this payment to be made to the employee. The most popular gift card would seem to be One4All gift cards. Thesaurus Payroll Manager offers unique integration with One4All allowing employers to purchase gift cards quickly and easily for their employees. The integration offers a range of benefits, including:

- The ability to pay via EFT, a facility not available to regular gift card customers

- No additional charges, unlike when purchasing direct from the Post Office

- Tracking of gift cards purchased so that you as an employer are alerted if you attempt to purchase more than one gift card for an employee in any one tax year

- Prevention from ordering a card in excess of the exemption limit, i.e. €500.

Please note: where a benefit exceeds €500 in value, the entire amount will be subject to PAYE, PRSI and USC.

Purchasing gift cards through Thesaurus Payroll Manager is both simple and straightforward. To order, simply click on the Gift Card option, fill in your company details, select the amount for each employee's gift card and click to proceed to the gift card website. The software will bring you to the gift card website where you will arrange payment and delivery details.

It is also possible to order Me2You gift cards through Thesaurus Payroll Manager, if required tick to order from Me2You.

For further details click here.

To book a free online demo of Bright Contracts click here

To download your free trial of Bright Contracts click here

Making an Employee Redundant

Redundancy is never an easy decision for an employer to make but there may come a time when circumstances arise which leave an employer with no alternative but to declare redundancies.

A redundancy situation can often arise in the following situations:

- an employee’s job ceases to exist

- the employer ceases to carry on the business

- the requirement for employees has diminished

- an employee is not skilled for work that is to be done

In the event of a redundancy, employees are covered under Redundancy Payments Acts 1967-2014, if they meet the following requirements:

- aged 16 or over

- have at least 2 years continuous service (104 weeks)

- are a full-time employee insurable under PRSI class A, or PRSI Class J for a part-time employee

How to calculate Statutory Redundancy Pay

Statutory Redundancy is payable at a rate of:

- 2 weeks’ pay for each year of service. If the period of employment is not an exact number of years, the excess days are credited as a portion of a year

- plus one week’s pay

The term ‘pay’ refers to the employee’s current normal gross weekly pay, including average regular overtime and benefits in kind. The above, however, is based on a maximum earnings limit of €600 per week (before PAYE, PRSI & USC).

An employer may also choose to pay a redundancy payment above the statutory minimum. In such circumstances, the statutory payment element will be tax free but some of the lump sum payment may be taxable.

Employers should ensure that a redundancy policy is included in their company handbook and that all staff are aware of the procedures in place if redundancies were to arise.

To book a free online demo of Bright Contracts click here

To download your free trial of Bright Contracts click here

€7,500 awarded for unfair interview questions

The Workplace Relations Commission has awarded €7,500 to a woman they found was discriminated against during a job interview with Minister of State for Training, Skills, Innovation, Research John Halligan. Mr. Halligan, during the course of the interview, said to the woman “I shouldn’t be asking you this, but....are you a married woman? Do you have children? How old are your children?”

Mr. Halligan said that the questions were asked in good faith as he wanted to make her aware that flexible working hours to allow his staff to take care of their families is something that he encourages. The WRC however, found that the questions were discriminatory under the Employment Equality Acts 1998-2005.

The legislation defines discrimination as treating one person in a less favourable way than another based on any of the following 9 grounds:

- Gender

- Civil Status

- Family Status

- Sexual Orientation

- Religion

- Age

- Disability

- Race

- Membership of the Traveller community

When conducting an interview it is important for employers to build rapport with the candidate but they also need aware that asking questions or making comments in relation to the above 9 grounds will leave you at risk of a hefty discriminatory claim, even if you think you are just making small talk.

So what questions are appropriate and inappropriate to ask in a job interview?

Appropriate Interview Questions

- Are you able to perform the specific duties of this position?

- What days can you work? What hours can you work?

- Are you available to work overtime on occasion?

- Are you available to travel on occasion?

- Are you able to start work at 8 am?

- What are your long-term career goals?

- Do you have any responsibilities that would interfere with traveling for us?

Inappropriate Interview Questions

- Do you have or plan to have children?

- If you get pregnant, will you continue to work, and will you come back after maternity leave?

- What are your child care arrangements?

- Are you married /engage?

- How many children do you have? Do you have a babysitter available if we need you on a weekend? Do the working hours fit with your childcare?

- Do you have a baby or small child at home?

Employment and equality legislation doesn’t just start once you hire someone, it’s applicable the moment you post a job advert. With this in mind employers need to be mindful of what they say even when making small talk and building rapport with candidates before and after the job interview.

To view our full Interviewing Guidelines click here

Also see our blog ‘Be careful of discrimination in job interviews’ here

To book a free online demo of Bright Contracts click here

To download your free trial of Bright Contracts click here

How to avoid harassment in the workplace

The recent allegations against Harvey Weinstein n the US have created somewhat of a snowball effect worldwide with thousands of women and men speaking out about their accounts of sexual harassment and assault, many of them being work related. Allegations involving high profile individuals and people in authority have demonstrated just how widespread a problem this has become across all industries and professions and has exposed a sinister culture of silence, fear and acceptance which we must now turn on its head.

The Employment Equality Acts clearly defines sexual harassment as: forms of unwanted verbal, non-verbal or physical conduct of a sexual nature which has the purpose or effect of violating a person’s dignity and creating an intimidating, hostile, degrading, humiliating or offensive environment for the person.

It is important for employers to ensure that harassment will not be tolerated and to portray this to their employees and clients. Employers are therefore compelled to take steps to ensure a harassment-free work environment. Effectively, organisations must set down clearly defined procedures to deal with all forms of harassment including sexual harassment.

There are a number of steps an employer can take to help prevent this type of behavior from occurring in the workplace:

A Bullying and Harassment policy

- to protect the dignity of employees and to encourage respect in the workplace

An Equal Opportunities policy

- to create a workplace which provides for Equal Opportunities for all staff

A Whistle-blowing policy

- to enable staff to voice concerns in a responsible and effective manner.

Transparent and fair procedures throughout

Disciplinary action

- A sanction that is appropriate for the level of alleged harassment – to help try and change the culture of silence that has allowed harassment to become normal and protected.

Provision of on-going training

- At all levels within organisation

Bright Contracts has a fully customisable Staff Handbook, which includes a Bullying and Harassment Policy and also an Equality Policy and Whistleblowing Policy.

To book a free online demo of Bright Contracts click here

To download your free trial of Bright Contracts click here

Premature Births and Maternity Benefit

From 1st October 2017, the period for which Maternity Benefit is paid has been extended in cases where a baby is born prematurely. A premature birth is described as one at less than 37 weeks’ gestation. It is estimated that every year in Ireland approximately 4,500 babies are born prematurely.

Currently, under the Maternity Protection Acts 1994 and 2004, a mother is entitled to 26 weeks’ maternity leave and 16 weeks’ unpaid leave. Maternity leave normally starts two weeks before the baby’s expected due date or on the date of the birth of the child, should it be earlier.

Under the new amendment, where a child is born prematurely the mother’s paid maternity leave will be extended by the equivalent of the duration between the actual date of birth of the premature baby and the date when the maternity leave was expected to start. For example, where a baby is born in the 30th week of gestation the mother would have an additional entitlement of approximately seven weeks of maternity leave and benefit i.e. from the date of birth in the 30th week to the two weeks before the expected date of confinement. This additional period will be added on to the mother’s normal entitlement to 26 weeks of maternity leave and benefit, where the mother meets the ordinary qualifying criteria.

Mothers of pre-term babies are advised to contact the Department of Employment Affairs and Social Protection (DEASP), email [email protected], to arrange the additional payment.

Babies surviving from the earliest gestation's, such as 23 weeks, can spend months in a neonatal unit in hospital, by the time a premature baby gets to go home, a mother’s maternity leave can almost be used up. This new change has been heralded as a positive step in supporting parents during a difficult time.

To book a free online demo of Bright Contracts click here

To download your free Bright Contracts trial click here

10% pay rise for Construction Sector under new Sectoral Employment Order

A Sectoral Employment Order (SEO) for the general construction industry has been signed into law by the Minister for State at the Department of Business, Enterprise and Innovation, Pat Breen.

Effective from 19th October 2017, the order provides for mandatory terms and conditions in the construction sector, including pay, pensions and sick leave. In finalising the Order, the Labour Court received submissions from the Construction Industry Federation (CIF), UNITE the Union, the Irish Congress of Trade Unions and the Trustees of the Construction Workers Pension Scheme.

Who does the Order affect?

The Order applies to employers in the construction sector, regardless of whether or not they are CIF members. The sector is defined to include both “Building Firms” and “Civil Engineering Firms”, examples will include companies involved in; construction, reconstruction, alteration, repair, painting and decorating. It is estimated that the new Order will apply to approximately 50,000 workers. Notably electricians and plumbers are not included.

Hourly Rates

The new minimum hourly pay rates are:

- New Entrant Workers: €13.77

- Category 1 Workers (General Operatives with more than 1 years’ experience: €17.04

- Category 2 Workers (Skilled General Operatives): €18.36

- Craft Workers (Includes: Bricklayers, Carpenters, Plasterers): €18.93

- Apprentices

- Year 1: 33.3% of Craft Rate

- Year 2: 50% of Craft Rate

- Year 3: 75% of Craft Rate

- Year 4: 90% of Craft Rate

These new rates are approximately 10% higher than they had been under the previous Registered Employment Agreement (REA).

Unsocial Hours

The following unsocial hours payments will now apply:

- Monday to Friday, normal finish time to midnight: time and a half

- Monday to Friday, midnight to normal starting time: double time

- Saturday, first four hours from normal starting time: time and a half. All subsequent hours until midnight: double time

- Sunday, all hours worked: double time

- Public holidays, all hours worked: double time plus an additional day’s leave

Pension Scheme and Sick Pay Scheme

The Order provides that employers must provide pension benefits with no less favourable terms than those in the Construction Workers Pension Scheme (CWPS). The Order also provides for a mandatory sick pay scheme, in recognition of the health and safety risks posed to industry workers.

Dispute Resolution

The Order includes a new dispute resolution procedure. No strike or lock-out is allowed unless and until all stated dispute resolution procedures have been exhausted.

Where to from here?

The Order is a significant development for those in the general construction industry. Employers will need to review their payment practices to ensure that they comply with the new requirements.

To keep up with the latest payroll news, check out our new Bright website. There, you'll be able to register for any of our upcoming payroll webinars and download our payroll guides.

To book a free online demo of Bright Contracts click here

To download your free trial of Bright Contracts click here

Does my employee need a written statement of employment?

The main purpose of the written statement of employment, often referred to as the contract of employment, is to clarify the terms of a person’s employment and avoid uncertainty or misunderstandings, where employee expectations might not be the same as employer intentions.

The Terms of Employment (Information) Acts 1994 require an employer to provide an employee with a written statement of their terms of employment within 2 months of commencement of employment. The above Act covers all employees working under a contract of employment, including full-time staff, part-time staff, fixed-term and casual workers.

The written statement must include the following information:

- The full name of employer and employee

- The address of the employer

- Place of work

- Job title or nature of work

- The date the employment started

- Type of contract

- Rate of pay

- Pay intervals

- Hours of work

- Paid leave

- Incapacity for work, sick pay

- Any terms relating to a pension scheme

- Period of notice to be given by employer or employee

- Details of any collective agreements

- Pay reference period

Additional clauses can be recommended to further clarify the relationship. These might include:

- Probation clause

- Pay in lieu of notice clause

- Confidentiality clause

- Right to search

- The calculation of holiday pay

Failure to comply with the above Act could leave employers open to a claim from their employees. Employers found not to have written terms of employment in place will be fined a maximum of 4 weeks’ remuneration per employee. Clearly worded contracts of employment are key to the success of any business. They will ensure your business is on the right side of employment law as well as help prevent disputes with employees.

To book a free online demo of Bright Contracts click here

To download your free trial of Bright Contracts click here

Budget 2018 - Employer Payroll Focus

Pay As You Earn (PAYE)

- There was no change to tax rates for 2018, the standard rate will remain at 20% and the higher rate at 40%.

- Standard Rate Cut Off Points (SRCOPs) will be increased by €750 from 1st January 2018.

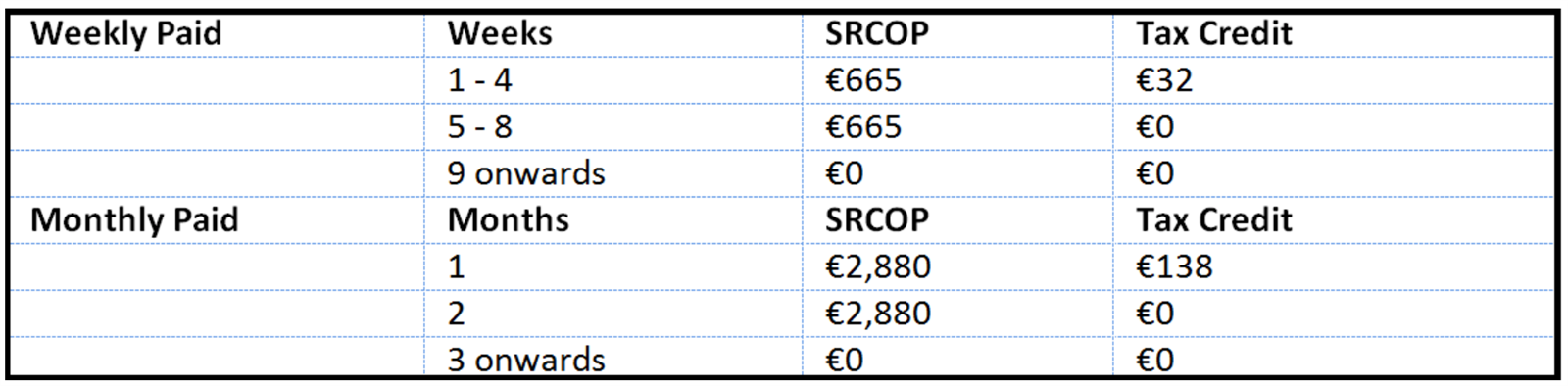

Emergency Basis of PAYE

Employee provides PPS Number:

Where an employee does not provide their PPS Number the higher rate of 40% tax applies to all earnings.

Earned Income Tax Credit

The Earned Income Tax Credit will be increased by €200 from €950 to €1,150.

Home Carer Tax Credit

The Home Carer Tax Credit will be increased from €1,100 to €1,200.

Universal Social Charge (USC)

- Exemption threshold remains at €13,000

- 2.5% rate reduced to 2%, threshold for this rate increased from €18,772 to €19,372

- 5% rate reduced by 0.25% to 4.75%

- No change to 8% rate

Medical card holders and individuals aged 70 years and older whose aggregate income does not exceed €60,000 will pay a maximum rate of 2%.

The emergency rate of USC remains at 8%.

PRSI & USC

The Minister outlined his intention to establish a working group in 2018 to carry out a review of the possible integration of PRSI and USC.

National Training Levy

The National Training Levy of 0.7% which is currently collected as part of the employer PRSI contribution will increase to fund further and higher education, the increases are as follows:

- 0.8% in 2018

- 0.9% in 2019

- 1% in 2020

Pay Related Social Insurance (PRSI)

There were no changes to general PRSI thresholds or employee PRSI announced in the Budget. However, as the National Training Levy is increasing and it is collected as part of the employer PRSI contribution, employer PRSI will increase as follows:

- 8.5% increased to 8.6%

- 10.75% increased to 10.85%

Benefit in Kind (BIK) - Electric Cars

A 0% rate of BIK will apply to electric vehicles provided by an employer to an employee in 2018 which is available for private use. Electricity used by the employee in the workplace to charge the car will also be exempt from BIK.

PAYE Modernisation

PAYE Modernisation will be effective from 1st January 2019. Budget 2018 has allocated €50 million for a project to enhance Revenue's IT capacity and to ensure employer compliance.

National Minimum Wage

The National Minimum Wage will increase from €9.25 to €9.55 per hour in respect of hours worked on or after 1st January 2018.

- Workers under age 18 will be entitled to €6.69 per working hour

- Workers in their first year of employment over the age of 18 will be entitled to €7.64 per working hour

- Workers in their second year of employment over the age of 18 will be entitled to €8.60 per working hour

Social Welfare Payments

There will be a €5 increase in all weekly Social Welfare payments with effect from 26th March 2018. The maximum personal rate of Illness Benefit will be increased to €198 per week. Maternity Benefit and Paternity Benefit will be increased to €240 per week.