Have we caught up with pay equality?

The gender pay gap is still very much a controversial issue right across Europe.

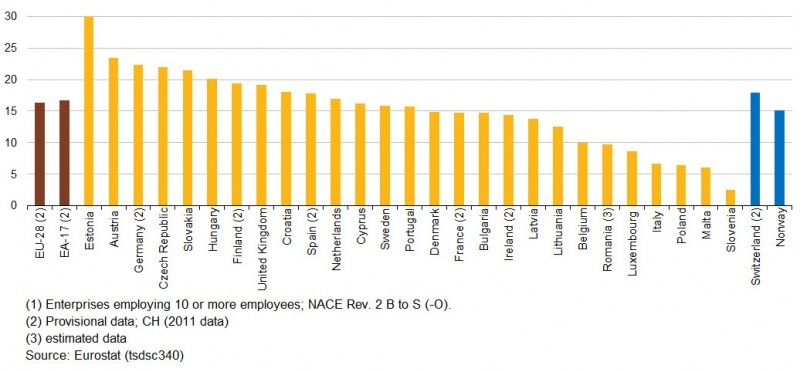

Recent research by the European Commission revealed that on average across Europe women’s earnings are 16.4% below those of men. According to the statistics, gender pay differences are highest in Estonia at 30%, Slovenia leads the table with only 2.5% and Ireland is placed in 10th position with 14.4%, ahead of countries such as the UK, Germany and France.

In terms of sector, the gender pay gap is generally higher in the financial and insurance sector. In Ireland pay inequality raises to 20.6% in business economy workplaces.

The gender pay gap for those under 25 years of age is lowest in almost all European countries, and gradually increases as women get older. Reflecting the fact that, women’s family responsibilities do contribute to inequality figures. This would suggest that greater flexibility around sharing of parental leave between both the mother and father would be beneficial.

However, responsibility does also lie with employers; employers have an obligation to ensure that where men and women are performing the same or similar duties, then they are entitled to be paid the same rate. Where this is found not to be the case, employers could find themselves defending an Equality Tribunal claim, as was the case for an Garda Siochana in 2012 when clerical staff successfully brought a case of unequal pay treatment in which the Garda where ordered to close a pay gap of €9,000 per year.

Last Saturday 8th March was International Women’s Day. The day celebrates the social, political and economic achievements of women while focusing world attention on areas requiring further action. Considering these result, it is fair to say that equal pay is an area where further action is required.

European Gender Pay Gap by Country

Employee unfairly dismissed for improper Internet use - €7,000 Award

On 17th December 2013, the Employment Appeals Tribunal in Mullingar heard a claim that an employee had been unfairly dismissed by her employer for improper internet use. The employee was employed as a Marketing Assistant in the wholesale electrical company from 1st November 2010. For the first year, the employee worked a 3 day week as she was completing a graphic design course. From the 1st November 2011 the employee began working a 5 day week

.

At the hearing the Managing Director claimed that both he and the Office Manager had warned the employee on a number of occasions about her non-work related internet use. The Managing Director claimed the warnings were of a verbal nature. The Managing Director said that on 16th January 2012 he witnessed the employee on a social media site and he called her to his office before proceeding to dismiss her from her employment with the Company.

The Company did not have a formal internet use/social media policy in place while the employee was employed. It also became apparent that the employee did not receive a contract of employment nor did she receive a copy of the Company’s disciplinary procedures.

The employee stated that she completed all work that was assigned to her and that she regularly requested more work to do during her working hours but was not provided with enough work to take up all her working hours. The employee explained that, if she was aware of the company’s policy around internet use/social media then she would have abided by it.

The Tribunal found that there was no gross misconduct on the part of the employee; the Tribunal found that the employee was Unfairly Dismissed and awarded her €7,000 in compensation under the Unfair Dismissals Acts 1977 to 2007.

How to Roll out Contracts & Handbooks to Existing Staff

Introducing a contract of employment or a handbook for the first time to current employees, can be a difficult, tricky matter for many employers.

It is an area that many employers put on the long finger, or avoid doing until they have to.

Common reasons for not implementing employee documentation include:

• Lack of time

• Fear that employees will refute the terms of the documents and refuse to sign

• Anxiety that documentation will harm the relationship between management and staff, if the employees feel a new set of rules are being entrust upon then

• A false belief that it will restrict how management deal with employees

However, this does not have to be the case. It is possible to introduce new documentation without spending huge amounts of time, alienating your work force, or causing disruption.

The answer lies in good communications.

To help employers introduce employee documentation, we’ve created a short video outlining our four step guide to rolling out contracts and handbooks.

Alternatively, read our guide to Introducing Contracts & Handbooks to Existing Staff available here http://www.brightcontracts.ie/docs/introducing-contracts-handbooks-to-existing-staff/

National Employment Week - Improving employment for everyone

The 4th National Employment Week takes place this week, 24th to 28th February. National Employment Week was established as a forum focusing on social and economic issues surrounding employment in Ireland. As the country endeavours to reduce the number of people out of work and move towards economic recovery, National Employment Week puts employment at the centre of the agenda.

The week offers the opportunity to employers, managers and HR professionals to share opinions and experience on employment issues and set the national employment agenda.

Although supported by Government, with both the Taoiseach and Minister for Social Protection, Joan Burton attending several events throughout the week, there is very much a commercial aspect to the week. The week itself has strong, reputable sponsorship with The Irish Times, The Chartered Institute of Personnel and Development (CIPD), Sigmar Recruitment and Monster.ie all involved. In addition all events, seminars and focus groups alike, are attended by professionals representing employers of all sizes and types across Ireland.

This year the focus will be on the following topics:

• Digital Innovation and the Drive for Talent

• Significance of Company Culture

• Emerging Talent

• The importance of investing in the future

• Mental Health & Employment

The highlight of the week is the National Employment Summit which takes place on Wednesday in the Convention Centre, Dublin. This is a free event and anyone can attend to hear practical measures that can be taken back to businesses.

National Employment Week is striving to achieve a better employment market for everyone. It is heartwarming to see such positive steps being taken. If you don’t make any of the events this year, mark it in your diary for next year. Further information can be found at http://www.nationalemploymentweek.ie/.

How to deal with employee absence due to bad weather

The last few weeks has seen the UK and Ireland battle record-breaking storms and floods. This has literally left many employers high and dry. So what do you do if your employee’s can’t attend work due to bad weather?

The last few weeks has seen the UK and Ireland battle record-breaking storms and floods. This has literally left many employers high and dry. So what do you do if your employee’s can’t attend work due to bad weather?

Employees must attend work unless they are on authorised absence, or if they are unwell. Under their contracts of employment, employees still have to attend work, even in extreme weather conditions. If the workplace remains open during the bad weather and the employee cannot make it in, the employer can treat the absence as un-authorised. In such situations, employers would be well within their rights to refuse to pay an employee who cannot make it into work.

However, employers should consider the impact of deducting pay on productivity and employee morale in the long run in these circumstances, especially if the weather makes it impossible to get to the workplace or the workplace is closed through no fault of the employees. Often in these situations the financial burden is compensated by the positive impact on morale and productivity.

In general, it is recommended that employers try to implement as flexible an approach as possible. Possible options can include:

• Having the employee take time off as annual leave. It should be noted that employers also cannot force their employees to take annual leave unless this is expressly provided for in the employment contract.

• Consider whether the employee can work from home

• Allow the employee to make up the time at a later date

Whatever option you do go with, make sure it is clearly communicated and consistently applied to all staff. It’ll make managing the situation a lot easier when the situation does arise.

What to do if you suspect an employee of stealing

Employee theft is a very real challenge for Irish employers. According to Retail Ireland, 39% of Irish retailers have experienced theft of stock by employees.

However, employer theft doesn’t have to be the direct theft of stock, products or cash, it can also include:

a) Manipulation of company records either to embezzle money or to hide the theft of goods

b) Aiding theft by another person

c) Theft of company information for personal or financial gain.

Should employers suspect theft in the workplace, they need to exercise caution in how they proceed. Employers who handle these matters incorrectly can often end up with costly employee claims.

Real Life Story

A sports shop owner in Donegal suspected an employee of stealing. He checked his CCTV and clearly saw the employee pocket money. The owner continued to review the CCTV footage and further incidents followed. The shop owner dismissed the employee for gross misconduct.

Fast forward 2 years later to the Employment Appeals Tribunal where the court finds in favour of the employee. Why? – because proper procedures were not followed.

Fast forward 2 years later to the Employment Appeals Tribunal where the court finds in favour of the employee. Why? – because proper procedures were not followed.

So what should you do?

The onus to prove theft actually took place will be on the employer, therefore it is essential that businesses have appropriate policies in place that will allow for a full and proper investigation. Such policies should include a Disciplinary Policy and a Right to Search Policy. If you don’t have a Search Policy you need to include one!

CCTV Surveillance

The use of CCTV surveillance is heavily regulated by Data Protection legislation. If employers want to rely on CCTV to provide a defense, they should:

a) Notify individuals of the presence of CCTV cameras, i.e. in the Staff Handbook and with signs

b) Never use hidden cameras to watch staff

Dos and Don’ts of Workplace Theft

Although each case will be different the below are general guidelines on how to approach concerns of theft.

|

Do |

Don't |

|

Conduct a full investigation |

Don’t take disciplinary action, including dismissal, without giving the individual the right to appeal |

|

Carefully follow your internal procedures, including Disciplinary policies and Right to Search |

Don’t urge employees to resign |

|

Notify employees if there is CCTV in operation |

Don’t threaten to call the Guards if you don’t intend to |

|

Act only on firm evidence, e.g. financial records, witness statements, CCTV |

Don’t forget that employees have the right to be accompanied to disciplinary meetings |

|

Give employees the opportunity to review and respond to any evidence you are relying on e.g. CCTV evidence |

|

To book a free online demo of Bright Contracts click here

To download your free Bright Contracts trial click here

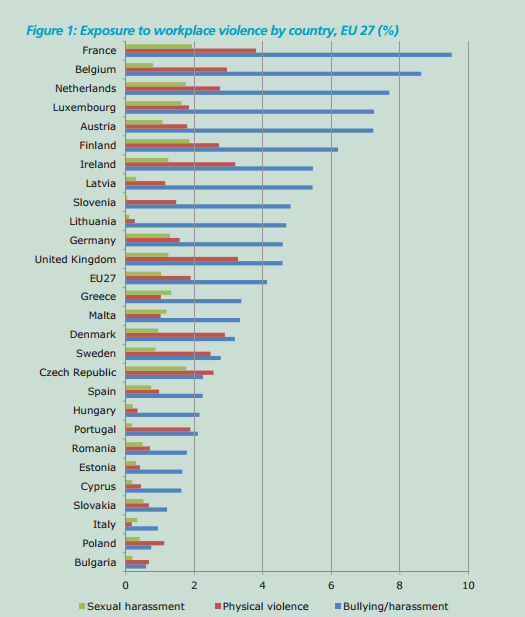

Workplace Bullying in Ireland amongst the highest in Europe

Newly published research places Ireland as the 7th worst EU country for workplace bullying. The research, conducted by the European Foundation for the Improvement of Living and Working Conditions, also found that Ireland rated highly for cases of physical violence and sexual harassment.

According to the research approximately 6% of European workers have been victims of some form of bullying, whether it is verbal, psychological, physical, or sexual harassment over the last 12 months.

Speaking in response to the finding SIPTU’s Tom O’Driscoll has commented that SIPTU, at any given time could have “over one hundred (bullying cases)”. He said, “bullying mainly comes from managers or those in positions of power but can be colleague on colleague.”

Workplace bullying can have an extremely disruptive effect not only on an individual’s performance at work but also on their home-life and their psychological wellbeing.

Employers need to be vigilant in this area, and take proactive steps to remove bullying from their workplaces. This will include:

- Having robust bullying and harassment policies and procedures in place

- Taking all complaints of bullying or harassment seriously, taking appropriate action

- Acting immediately if bullying or harassment is suspected in the workplace – not procrastinating

- Training all managers fully on managing employees

NERA Statistics

In the first 6 months of 2013, NERA dealt with 28,794 queries. One of the main topics the queries dealt with related to the terms and conditions of employment.

In the same period NERA made 2,755 workplace inspections, 42% of those inspected were non-compliant and in breach of their employer duties. 29 convictions resulted in fines €400,000 imposed.

Reintroduction of Employment Regulation Orders in Hospitality, Catering, Retail-Grocery, Contract Cleaning, Security and Agriculture sectors one step closer.

The reintroduction of Employment Regulation Orders in six relevant sectors: Hospitality, Catering, Retail-Grocery, Contract Cleaning, Security and Agriculture came a step closer last week when on January 28th 2014 the Minister for Jobs, Enterprise and Innovation, Richard Bruton TD, signed Orders giving effect to recommendations contained in the Labour Court Review of the Joint Labour Committees (JLC) which the Minister had published on October 2nd 2013.

It should be stressed that the ministerial order establishes Joint Labour Committees only at this stage. Employment Regulation Orders will not come into effect unless agreed by the parties.

When this occurs, it is intended to update this feature in Bright Contracts package in order to assist employers within these sectors.

This development is part of an overall process that will reduce the number of previous JLCs by half and make further changes to improve competitiveness by enhancing wage flexibility while at the same time ensuring protection for vulnerable workers.

The Orders signed by Minister Bruton provide for the abolition of two existing Joint Labour Committees i.e. Dublin Hotels and Law Clerks

They also provided for amendments to the existing JLC Establishment Orders in respect of:

- Contract Cleaning

- Hairdressing

- Hotels (non-Dublin and Cork)

- Security

The Minister indicated that, as the Agricultural Workers JLC was established under primary legislation, effecting the recommendation of the Labour Court Review will require an amendment to primary legislation. In this regard his officials are engaged with the Department of Agriculture, Food and Marine to see how this can be implemented as early as possible.

The Minister also indicated that it is not his intention to alter the current scope of the two catering JLCs or the Retail Grocery JLC.

Minister Bruton said: “From the start of this process I have said that reform in this area is necessary in order to make the system fairer and more responsive to changing economic circumstances and support job-creation.

“The Orders I have signed will provide the framework within which employee representatives can come together voluntarily to negotiate terms and conditions for workers in their respective sectors. For vulnerable workers, the advantage of JLCs is that they see fair terms and conditions such as wage rates, sick pay etc. agreed and given effect by Employment Regulation Orders. For employers, the advantage of the JLC system, based on the principle of self-governance, means that they can agree and set minimum pay and conditions, agree on work practices which are custom-made to their industry – a flexibility which cannot be achieved by primary legislation. Where both parties to a JLC see commonality of purpose and outcome then an agreement may emerge”.

Christmas Bonuses

Christmas is a time for giving! As such, many employers use it as opportunity to give back to their employees for their hard-work and contribution throughout the year. Done correctly, bonuses can be an excellent way of motivating and engaging staff.

However, over the last number of years companies have found it increasingly difficult to be able to afford bonuses. This year Eason bookstores has deferred paying Christmas Bonus to over 800 staff in an effort to reduce costs.

Companies, who have paid bonuses for many years and then stop, need to do so cautiously, as the bonus may have become an implied term of the contract of employment. As such, stopping bonus payments could be seen as a breach of contract. Easons itself is in deep negotiation with Siptu regarding their bonus payments.

One way to protect the company against this is to have a clear written statement on bonus payments in the contract of employment. The statement should clearly state that any bonus payments will be non-contractual, or at the very least, clarify that the Company reserves the right to amend the structure of the bonus scheme.

Employers should bear in mind that, monetary bonuses will be taxable, however employees can receive one non-monetary gift per year up to the value of €250 which will be exempt from PAYE/PRSI.

Possible options for utilising this benefit include:

- Vouchers: these generally include:

OneForAll Gift Vouchers

Restaurant Vouchers

Supermarket Vouchers

- A turkey or ham

- A case of steaks

- A team lunch