Why not get more for you and your employees when making Bonus payments?

As the long dark evenings set in and Halloween is over, the build up to the most wonderful time of the year will begin again! At this time of the year a significant amount of employers pay-out a Christmas/annual bonus and no matter how little or large the bonus is, a large portion ends up being paid over to the Revenue if it is put through the payroll as a taxable addition.

For example, if an employee’s salary is €35,000 per annum and they receive a bonus of €1,000 at Christmas, this employee would only receive around half of this amount after tax, employee PRSI and USC. The company would also be liable to pay 10.75% employer PRSI on the bonus, so in addition to giving the bonus of €1,000 there is also the extra €107.50 meaning the bonus is in fact costing the company €1,107.50.

The Solution

Revenue allow one small non-cash benefit per employee per annum up to the value of €500, PAYE, PRSI OR USC do not need to be applied to the benefit. A gift card or voucher seems to be the most popular way of allowing this payment to be made to the employee. The most popular gift card would seem to be One4All gift cards. Thesaurus Payroll Manager offers unique integration with One4All allowing employers to purchase gift cards quickly and easily for their employees. The integration offers a range of benefits, including:

- The ability to pay via EFT, a facility not available to regular gift card customers

- No additional charges, unlike when purchasing direct from the Post Office

- Tracking of gift cards purchased so that you as an employer are alerted if you attempt to purchase more than one gift card for an employee in any one tax year

- Prevention from ordering a card in excess of the exemption limit, i.e. €500.

Please note: where a benefit exceeds €500 in value, the entire amount will be subject to PAYE, PRSI and USC.

Purchasing gift cards through Thesaurus Payroll Manager is both simple and straightforward. To order, simply click on the Gift Card option, fill in your company details, select the amount for each employee's gift card and click to proceed to the gift card website. The software will bring you to the gift card website where you will arrange payment and delivery details.

It is also possible to order Me2You gift cards through Thesaurus Payroll Manager, if required tick to order from Me2You.

For further details click here.

To book a free online demo of Bright Contracts click here

To download your free trial of Bright Contracts click here

Have we caught up with pay equality?

The gender pay gap is still very much a controversial issue right across Europe.

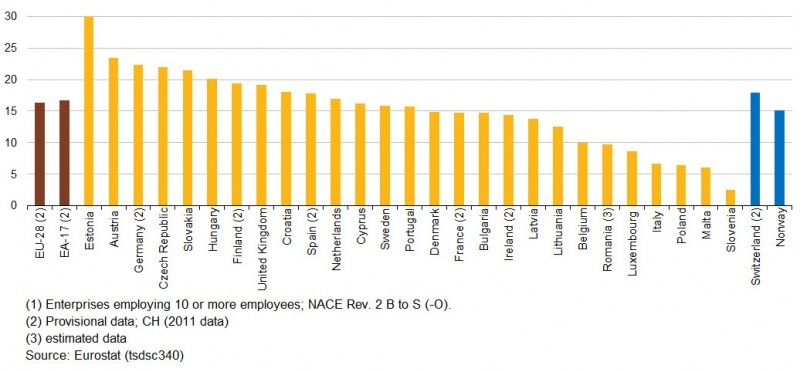

Recent research by the European Commission revealed that on average across Europe women’s earnings are 16.4% below those of men. According to the statistics, gender pay differences are highest in Estonia at 30%, Slovenia leads the table with only 2.5% and Ireland is placed in 10th position with 14.4%, ahead of countries such as the UK, Germany and France.

In terms of sector, the gender pay gap is generally higher in the financial and insurance sector. In Ireland pay inequality raises to 20.6% in business economy workplaces.

The gender pay gap for those under 25 years of age is lowest in almost all European countries, and gradually increases as women get older. Reflecting the fact that, women’s family responsibilities do contribute to inequality figures. This would suggest that greater flexibility around sharing of parental leave between both the mother and father would be beneficial.

However, responsibility does also lie with employers; employers have an obligation to ensure that where men and women are performing the same or similar duties, then they are entitled to be paid the same rate. Where this is found not to be the case, employers could find themselves defending an Equality Tribunal claim, as was the case for an Garda Siochana in 2012 when clerical staff successfully brought a case of unequal pay treatment in which the Garda where ordered to close a pay gap of €9,000 per year.

Last Saturday 8th March was International Women’s Day. The day celebrates the social, political and economic achievements of women while focusing world attention on areas requiring further action. Considering these result, it is fair to say that equal pay is an area where further action is required.

European Gender Pay Gap by Country

National Employment Week - Improving employment for everyone

The 4th National Employment Week takes place this week, 24th to 28th February. National Employment Week was established as a forum focusing on social and economic issues surrounding employment in Ireland. As the country endeavours to reduce the number of people out of work and move towards economic recovery, National Employment Week puts employment at the centre of the agenda.

The week offers the opportunity to employers, managers and HR professionals to share opinions and experience on employment issues and set the national employment agenda.

Although supported by Government, with both the Taoiseach and Minister for Social Protection, Joan Burton attending several events throughout the week, there is very much a commercial aspect to the week. The week itself has strong, reputable sponsorship with The Irish Times, The Chartered Institute of Personnel and Development (CIPD), Sigmar Recruitment and Monster.ie all involved. In addition all events, seminars and focus groups alike, are attended by professionals representing employers of all sizes and types across Ireland.

This year the focus will be on the following topics:

• Digital Innovation and the Drive for Talent

• Significance of Company Culture

• Emerging Talent

• The importance of investing in the future

• Mental Health & Employment

The highlight of the week is the National Employment Summit which takes place on Wednesday in the Convention Centre, Dublin. This is a free event and anyone can attend to hear practical measures that can be taken back to businesses.

National Employment Week is striving to achieve a better employment market for everyone. It is heartwarming to see such positive steps being taken. If you don’t make any of the events this year, mark it in your diary for next year. Further information can be found at http://www.nationalemploymentweek.ie/.

Employer’s Checklist for NERA Inspections

Below you will find a handy employer’s checklist for a NERA (National Employment Rights Authority) inspection:

1. Do you have your employer’s registration number with the Revenue Commissioners?

2. Have you a list of all your employees together with their PPS numbers and addresses?

3. Have you the dates of commencement of employment for all employees? (And dates of termination if applicable?)

4. Have you given all your employees a written statement of terms and conditions of employment?

5. Have you the employees’ job classification?

6. Have you a record of their annual leave and public holidays taken by each employee?

7. Have you a record of hours worked for all employees?

8. Have you a record of all payroll details?

9. Can you prove that you provide your employees with a written statement of pay?

10. Have you a record or register of all employees under the age of 18?

11. Have you employment permits where applicable?

12. Have you filled out the template letter details that you will receive from NERA advising you of the inspection?

Bright Contracts – Employment contracts and handbooks

BrightPay – Payroll Software

Can Employees Be Paid Less Than The Minimum Wage?

The National Minimum Wage Act, 2000 states that the NMW is €8.65 per hour, there are some exceptions to this.

Where employees are under the age of 18 or within the first 2 years after the date of their first employment over the age of 18, the rate is €6.06 per hour

In the first 2 years after the date of first employment over the age of 18, the rate is €6.92 per hour in the first year and €7.79 per hour in the second year

Or

Where a trainee is doing a course which complies with S.I. No. 99 of 2000 for the 1st one third of the period the rate is €6.49 per hour, the 2nd one third the rate is €6.92 per hour, and the 3rd one third the rate is €7.79 per hour.

S.I. No 99 of 2000 is the Statutory Instrument which forms part of the National Minimum Wage Act, 2000

For the protection of both employees and employers a Contract of Employment, which is now a legal requirement, should be given to each employee as this will state clearly what is expected of both sides and will minimise or hopefully prevent issues arising that lead to ill feeling or disputes in the workplace.

Bright Contracts – Employment contracts and handbooks

BrightPay – Payroll Software

Information from NERA on Public Holiday Entitlement Christmas 2012

It’s that time of year when debates arise in many workplaces over entitlements to Public Holidays and appropriate payment for them. NERA, the employment rights body have helpfully set out guidance in relation to this festive challenge for all concerned. This guidance is set out below:

“Full-time workers have immediate entitlement to benefit for public holidays and part-time workers have entitlement to benefit when they have worked 40 hours in the previous 5 weeks.

Christmas Day, Stephens Day and New Year’s Day are public holidays. Christmas Eve is not a public holiday.

When a person works on either or both of these days they are entitled to be paid for each day in accordance with their agreed rates. In addition they also have an entitlement to benefit for each public holiday. This can be different for each public holiday and each employee depending on the individuals work pattern.

If the business is closed on the public holiday and an employee would normally be due to work then they get their normal days’ pay.

If the business is open and the employee works, they are entitled to either, paid time off or an additional days pay. This additional days’ pay is what was paid for the normal daily hours last worked before the public holiday.

If an employee is not normally rostered to work then they will be entitled to one fifth of their normal weekly wage.

If someone ceases to be employed during the week before a public holiday, having worked the four weeks preceding that week, they are entitled to benefit in respect of that public holiday

If a person is on temporary lay-off they are entitled to benefit for the public holidays that fall within the first thirteen weeks of layoff.”

Source: NERA Information Services

Bright Contracts – Employment contracts and handbooks

BrightPay – Payroll Software